Exness Trading Platform: Independent Guide and Market Insights

Home

Exness Overview and Services

Exness operates as a global multi-asset broker providing trading services through authorized entities worldwide. In South Africa, Exness ZA (Pty) Ltd operates under Financial Sector Conduct Authority (FSCA) regulation with FSP number 51024. The company provides access to international financial markets through various trading instruments, including forex, commodities, indices, and stocks via CFDs. Through advanced technology and dedicated support, Exness serves over 800,000 active traders globally.

Key Information | Details |

Regulation | FSCA (South Africa) |

License Number | FSP 51024 |

Min. Deposit | $10 |

Trading Platforms | MT4, MT5, Exness Terminal |

Customer Support | 24/7 multilingual |

Trading Instruments | Forex, Commodities, Stocks, Indices |

Trading Account Types

Exness offers diverse account types designed to meet various trading requirements. The Standard account provides commission-free trading with competitive spreads starting from 0.2 pips. Professional accounts include Zero and Raw Spread options, featuring enhanced execution speeds and tighter spreads. The Standard Cent account enables trading with micro-lots, making it accessible for traders starting with smaller capital.

Trading Platforms and Tools

The company provides multiple trading platforms to ensure traders can access markets effectively. MetaTrader 4 and 5 platforms offer comprehensive technical analysis tools and automated trading capabilities. The proprietary Exness Terminal provides a web-based solution with advanced charting and one-click trading features. Mobile applications enable trading on both iOS and Android devices.

Platform Features

- Real-time price quotes and market execution

- Advanced charting tools with multiple timeframes

- Expert Advisors (EAs) support

- Custom indicators and trading robots

- Economic calendar integration

- Mobile trading capabilities

Trading Conditions

Trading conditions at Exness emphasize transparency and competitive pricing. Spreads vary by account type and instrument, starting from 0 pips on certain professional accounts. Leverage options extend up to 1:unlimited, allowing traders to optimize their trading strategy according to their risk management preferences. The company maintains segregated client funds in tier-1 banks for enhanced security.

Deposit and Withdrawal Systems

The payment processing system supports multiple local and international payment methods. Withdrawals are processed instantly for 95% of requests, with the company covering transaction fees. Available payment options include bank transfers, credit cards, and various electronic payment systems.

Payment Method | Processing Time | Fees |

Bank Transfer | 1-3 business days | No fees |

Credit Cards | Instant | No fees |

E-wallets | Instant | No fees |

Security Measures

Security remains a primary focus, with multiple protective measures implemented. These include SSL encryption for data transmission, two-factor authentication for account access, and regular security audits. The company maintains PCI DSS certification, ensuring secure handling of payment information.

Customer Support Services

Support services operate 24/7 with multilingual assistance available through multiple channels. The support team provides technical assistance, account-related help, and trading guidance. Response times average under one minute for live chat support.

Regulatory Compliance

Exness maintains strict compliance with regulatory requirements. The company follows FSCA guidelines for client protection, including segregated client funds and negative balance protection. Regular audits ensure continued adherence to regulatory standards.

Market Analysis Resources

Traders receive access to comprehensive market analysis tools and educational resources. This includes daily market updates, technical analysis, and economic calendars. The platform integrates with Trading Central for additional analytical insights and trading signals.

Educational Materials

- Detailed trading guides and tutorials

- Market analysis videos

- Trading webinars and seminars

- Technical analysis courses

- Risk management education

- Trading strategy guides

Account Protection Features

Client funds benefit from multiple protection mechanisms. These include segregated accounts in major banks, stop-out protection features, and insurance against negative balances. The company maintains transparent reporting of all trading activities.

Protection Mechanisms

- Segregated client funds

- Negative balance protection

- Stop-out protection system

- Secure payment processing

Regular account monitoring

Trading Instruments Range

The platform provides access to over 200 trading instruments. These include major and minor currency pairs, precious metals, energy commodities, global indices, and popular stocks. Cryptocurrency CFDs are also available for trading.

Instrument Type | Number Available | Average Spread |

Forex Pairs | 100+ | From 0.2 pips |

Commodities | 15+ | From 1.2 pips |

Indices | 20+ | From 1.8 pips |

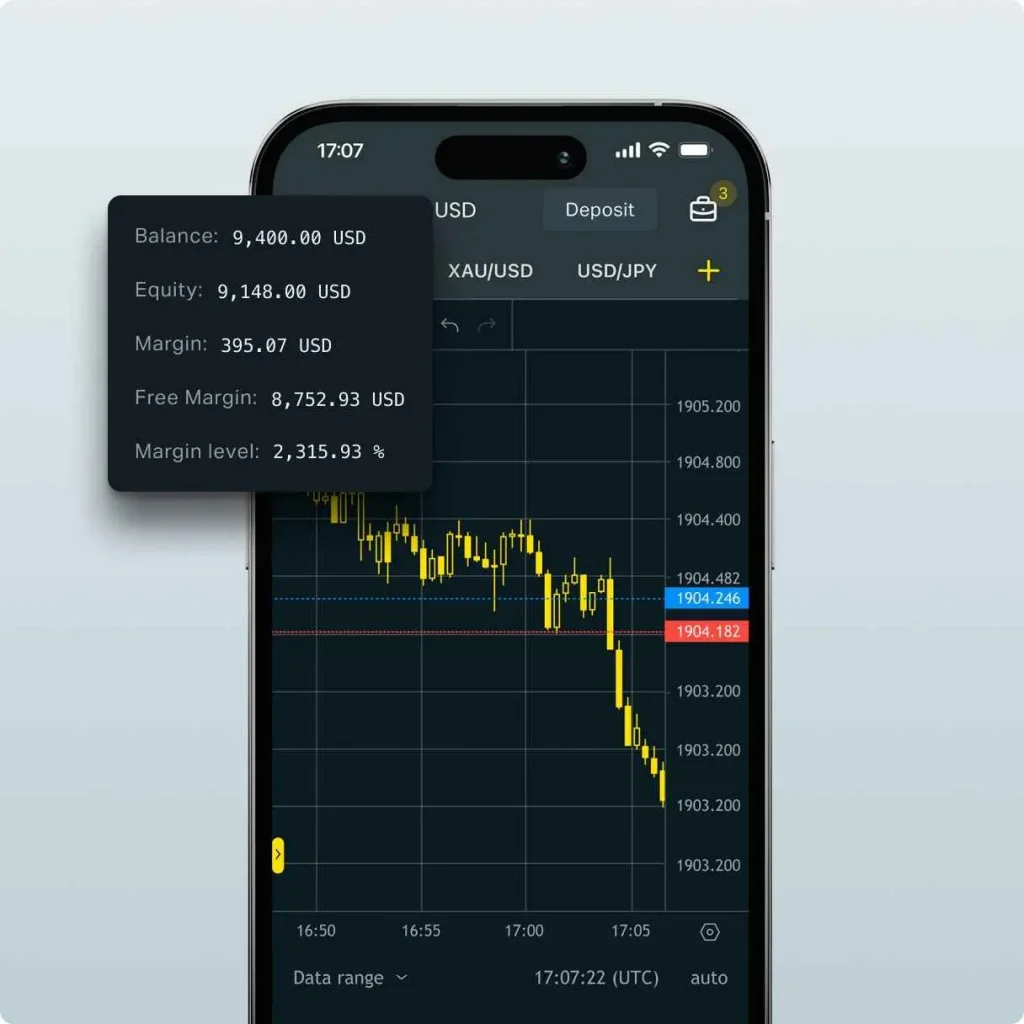

Mobile Trading Experience

The Exness Trade app delivers comprehensive mobile trading functionality. Mobile platforms synchronize with desktop versions, ensuring consistent trading experiences across devices. Push notifications keep traders informed of market movements and account activities. The application supports multiple chart types and technical indicators. Advanced order management features enable complete trading control from mobile devices.

Mobile Platform Features

• Real-time price streaming

• Advanced charting tools

• Multiple order types

• Account management tools

• Price alerts system

• One-click trading options

Risk Management Tools

Risk management capabilities include customizable stop-loss and take-profit orders. The platform provides margin calculators and position sizing tools. Traders can implement trailing stops and hedging strategies. The system includes automated risk monitoring and position management features. Advanced order types support sophisticated risk control strategies.

Execution Technology

Trading servers utilize advanced infrastructure for minimal latency. Order execution occurs within milliseconds across all instruments. The system maintains stability during high-volatility market conditions. Multiple data centers ensure reliable service delivery. Sophisticated price aggregation systems provide competitive quotes.

Technical Infrastructure

• Multiple data centers

• Redundant systems

• Load balancing

• Advanced security protocols

• Real-time monitoring

• Backup power systems

FAQs

Exness maintains segregated client accounts in tier-1 banks, implements SSL encryption for data protection, and provides two-factor authentication for account access. The company holds PCI DSS certification and conducts regular security audits.

Account verification processing usually takes between 1-24 hours after submission of required documents. The process includes verification of identity and proof of residence documents.

The minimum deposit varies by account type, starting from $10 for Standard accounts. Professional accounts require a minimum deposit of $200 to access advanced trading features and conditions.