Account Types Exness

Home » Account Types

Account Types Overview

Exness provides multiple trading account types for South African traders, each designed to meet specific trading strategies and preferences. Operating under FSCA regulation FSP 51024, all account types maintain strict security standards while offering various trading conditions and features.| Account Type | Min Deposit | Spread From | Commission |

| Standard | R200 | 0.3 pips | No |

| Pro | R4,000 | 0.1 pips | No |

| Zero | R4,000 | 0 pips | $3.5 per lot |

| Raw Spread | R4,000 | 0 pips | $3.5 per lot |

Standard Account Features

The Standard account represents the primary trading solution for South African traders. This account type combines accessibility with comprehensive trading capabilities. The low minimum deposit requirement makes it suitable for traders starting their journey in financial markets. The account provides market execution and competitive spreads across all available instruments.

Pro Account Specifications

Professional accounts cater to experienced traders requiring advanced trading conditions. These accounts offer enhanced execution speed and tighter spreads compared to standard options. The professional category includes specialized account types focusing on different trading approaches and requirements. Each variation maintains specific advantages for particular trading strategies.

Zero Account Features

Zero accounts introduce commission-based trading with zero spread conditions, providing transparent cost structure for active traders. These accounts offer precise calculation of trading costs before position opening.

- Zero spread trading

- Fixed commission structure

- Market execution

- Advanced charting tools

- Direct market access

Zero accounts maintain popularity among traders focusing on scalping and high-frequency trading strategies through competitive pricing models.

Raw Spread Account Characteristics

Raw Spread accounts deliver institutional-grade trading conditions through direct market access and minimal trading costs. The pricing structure combines ultra-low spreads with fixed commissions.

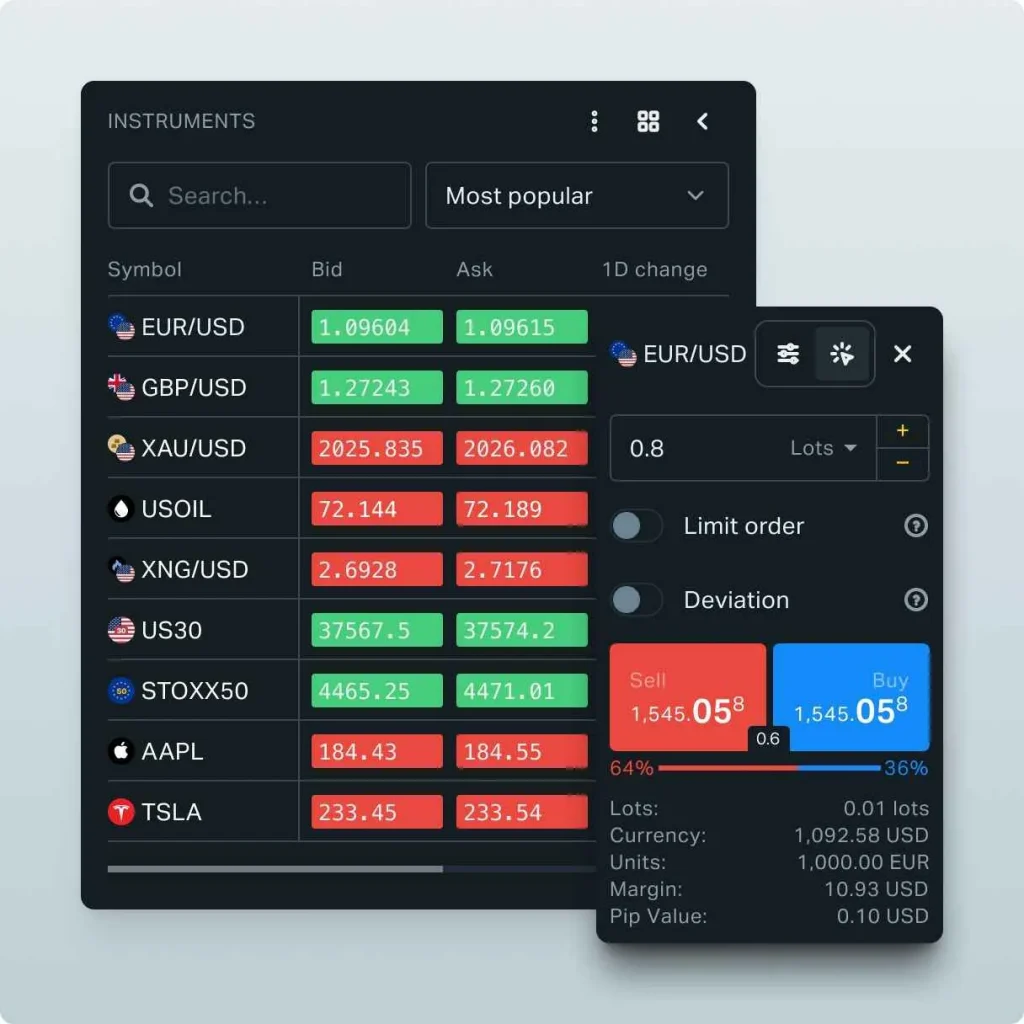

Trading Instrument Availability

Different account types provide access to varied instrument selections based on trading preferences. Market access includes forex, commodities, indices, and stocks.

- Major currency pairs

- Minor and exotic pairs

- Precious metals trading

- Index CFD access

- Stock CFD selection

Instrument availability remains consistent across all account types, ensuring comprehensive market access regardless of account selection.

Account Leverage Options

Trading leverage varies across account types, providing flexible risk management options. Initial margin requirements depend on selected leverage levels and instrument categories.

- Customizable leverage settings

- Instrument-specific ratios

- Risk management tools

- Margin calculation systems

- Position size optimization

Leverage settings remain adjustable through the personal area, allowing traders to modify risk exposure according to market conditions.

Execution Types and Methods

Account execution methods vary based on type selection and trading requirements. Market access speed depends on execution technology and server connections.

- Instant execution options

- Market execution systems

- Order processing speeds

- Requote protection

- Slippage controls

Advanced execution systems maintain order accuracy and processing speed across all trading conditions.

Account Currency Options

Multiple base currencies support efficient trading operations at Exness. Each account type accepts major global currencies, enabling traders to manage their funds effectively. The platform applies real-time conversion rates during transactions, ensuring accurate balance calculations across different currencies. Currency selection impacts all account operations, including deposits, withdrawals, and profit calculations. The system maintains separate balance tracking for each currency while providing consolidated reporting in the selected base currency. Account holders should consider their primary trading currency carefully as it affects overall trading costs and conversion fees.

Islamic Account Modifications

Islamic accounts at Exness accommodate specific trading requirements while maintaining full platform functionality. These accounts operate without traditional swap charges, adhering to religious principles. The platform implements alternative fee structures for extended position holding, ensuring sustainable trading operations. All major trading instruments remain available through Islamic accounts, with modified conditions for overnight positions. Traders can request Islamic account status through their personal area, with verification processes ensuring proper implementation. These modifications preserve essential trading capabilities while meeting specific account holder requirements.

Corporate Account Features

Corporate accounts provide institutional trading conditions with enhanced support and features. Documentation requirements follow South African regulations.

- Enhanced trading conditions

- Dedicated support access

- Custom solution options

- Corporate documentation

- Special pricing options

Corporate accounts require additional verification and maintain specific operational requirements.

FAQs

Standard accounts offer optimal conditions for beginners with low minimum deposits starting from R200 and straightforward trading conditions without commissions.

Zero and Raw Spread accounts charge fixed commissions but offer tighter spreads, making them more cost-effective for high-volume traders despite higher minimum deposits.

Yes, account type changes remain available through the personal area. New account requirements must be met, including minimum deposit levels for premium accounts.